Flexible AMOLED display panels will dominate the smartphone market in 2024, and the LCD era will come to an end

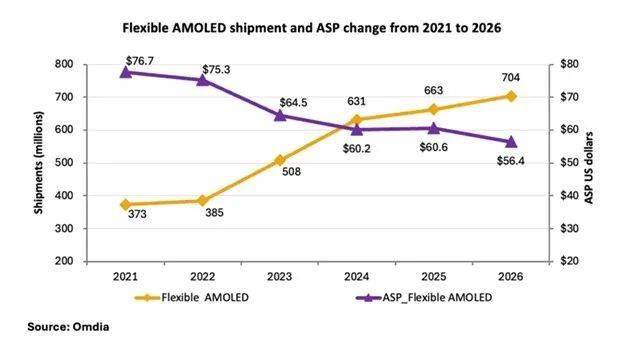

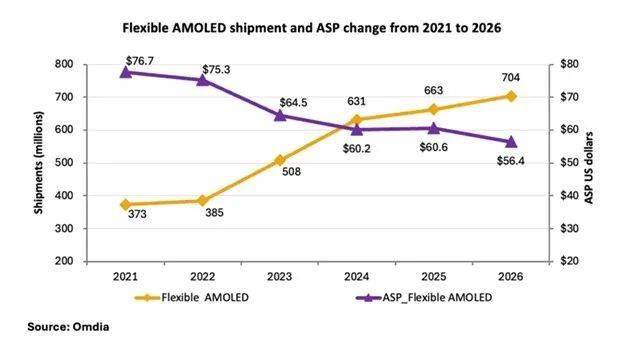

Recently, well-known research institution Omdia released the latest "Smart phone Display panel Intelligence Service" report, revealing the future development trend of smart phone display panel market. According to the report, by 2024, shipments of flexible AMOLED display panels will increase significantly to 631 million units, a significant increase of 24% compared to the previous year.

The report further points out that flexible AMOLED display panels are gradually becoming the dominant force in the smartphone display panel market. Its market share is expected to reach 42% by the end of this year, surpassing the 37% market share of amorphous silicon liquid crystal panels (a-Si LCDS). This change not only reflects the growing maturity of flexible AMOLED technology, but also reflects the demand of smartphone manufacturers for higher quality display panels.

In the smartphone display panel market, there are four main display panel technologies, including flexible AMOLED, rigid AMOLED, a-Si LCD and LTPS LCD. Among them, rigid AMOLED and LTPS LCD accounted for 12% and 10% of the market share, respectively. However, flexible AMOLED display panels are rapidly expanding their market presence with their superior performance and declining average selling price (ASP).

The report highlights that the sharp decline in the average selling price of flexible AMOLED display panels is a key factor driving its rapid market share growth. In 2023, shipments of flexible AMOLED display panels increased by 31.8 percent to 508 million units, while the average selling price decreased by 14.3 percent. This price advantage has prompted smartphone manufacturers to switch to using OLED display panels, further promoting the dominance of AMOLED technology (including flexible AMOLED and rigid AMOLED) in the smartphone display panel market.

However, this decline is expected to slow by 2025. According to the purchasing plans of smartphone manufacturers and the shipment targets of OLED manufacturers, it is expected that the supply and demand of flexible AMOLED display panels will reach a balanced state in 2025.

The report further points out that flexible AMOLED display panels are gradually becoming the dominant force in the smartphone display panel market. Its market share is expected to reach 42% by the end of this year, surpassing the 37% market share of amorphous silicon liquid crystal panels (a-Si LCDS). This change not only reflects the growing maturity of flexible AMOLED technology, but also reflects the demand of smartphone manufacturers for higher quality display panels.

In the smartphone display panel market, there are four main display panel technologies, including flexible AMOLED, rigid AMOLED, a-Si LCD and LTPS LCD. Among them, rigid AMOLED and LTPS LCD accounted for 12% and 10% of the market share, respectively. However, flexible AMOLED display panels are rapidly expanding their market presence with their superior performance and declining average selling price (ASP).

The report highlights that the sharp decline in the average selling price of flexible AMOLED display panels is a key factor driving its rapid market share growth. In 2023, shipments of flexible AMOLED display panels increased by 31.8 percent to 508 million units, while the average selling price decreased by 14.3 percent. This price advantage has prompted smartphone manufacturers to switch to using OLED display panels, further promoting the dominance of AMOLED technology (including flexible AMOLED and rigid AMOLED) in the smartphone display panel market.

However, this decline is expected to slow by 2025. According to the purchasing plans of smartphone manufacturers and the shipment targets of OLED manufacturers, it is expected that the supply and demand of flexible AMOLED display panels will reach a balanced state in 2025.